Wdv Method Of Depreciation Formula

5th Year - 410. 1 nth root of Residual ValueCost of the asset 100 where n useful life.

Written Down Value Method Of Depreciation Calculation

Where s scrap value at the end of period n.

Wdv method of depreciation formula. Under this method the depreciation is calculated at a certain fixed percentage each year on the decreasing book value commonly known as WDV of the asset book value less depreciation. SLM is easy to understand you can understand WDV Method also more easily with an example from our this post. Here we discuss calculation of depreciation amount using various methods along with examples downloadable excel template.

How to Calculate Depreciation under the Companies Act 2013. Using declining balance or written down value WDV method. Straight line method SLM of depreciation rate is 159519.

Written Down Value WDV method of depreciation rate is 4507. 3rd Year - 19. But the answer it gives for the above example is 840322 wherein if we calculate year wise it is 16800-239342-576263864395.

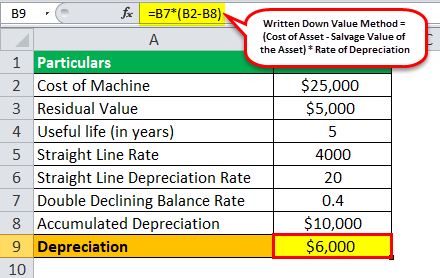

4th Year - 19. I purchased a machine on 1 january 2015 for 10000 and started charging depreciation on it at the rate of 10 and i am on 31 december 2019. The formula used to calculate WDV rates is Rate of Depreciation R 1 sc 1n.

In Income-tax Act we have the concept of Asset Blocks for which we use WDV Method to compute depreciation. 3rd Year - 1360. C Written down value at present.

For Written Down Method Formula is. Companies Act is silent on method of depreciation. Calculate the period from the date of purchase to.

WDV Depreciation Rate 1 sc 1n Here S is Scrap Value C is Cost of Asset and n is Useful Life in Years. Annual Depreciation Rate 1-Scrap value of assetCost of asset1remaining useful life of. Formula to calculate depreciation through WDV method The WDV method is considered the most logical method.

Related Topics Depreciation using Straight Line Method Visit Here. I tried using the formula - WDV as on Date Cost price x 1- Dep Rate Date of WDV Calculation - Date of Purchase 1365. Written down value or the reducing balance method of depreciation is a method in which depreciation is calculated at a fixed percentage on the original cost in the first year.

2nd Year - 19. 1st Year - 19. Rate of Depreciation R 1 sc1n.

Although it doesnt contain the rates to be used it provides the useful life to be used for different classes of assets. Where s scrap value at the end of period n. 2nd Year - 2476.

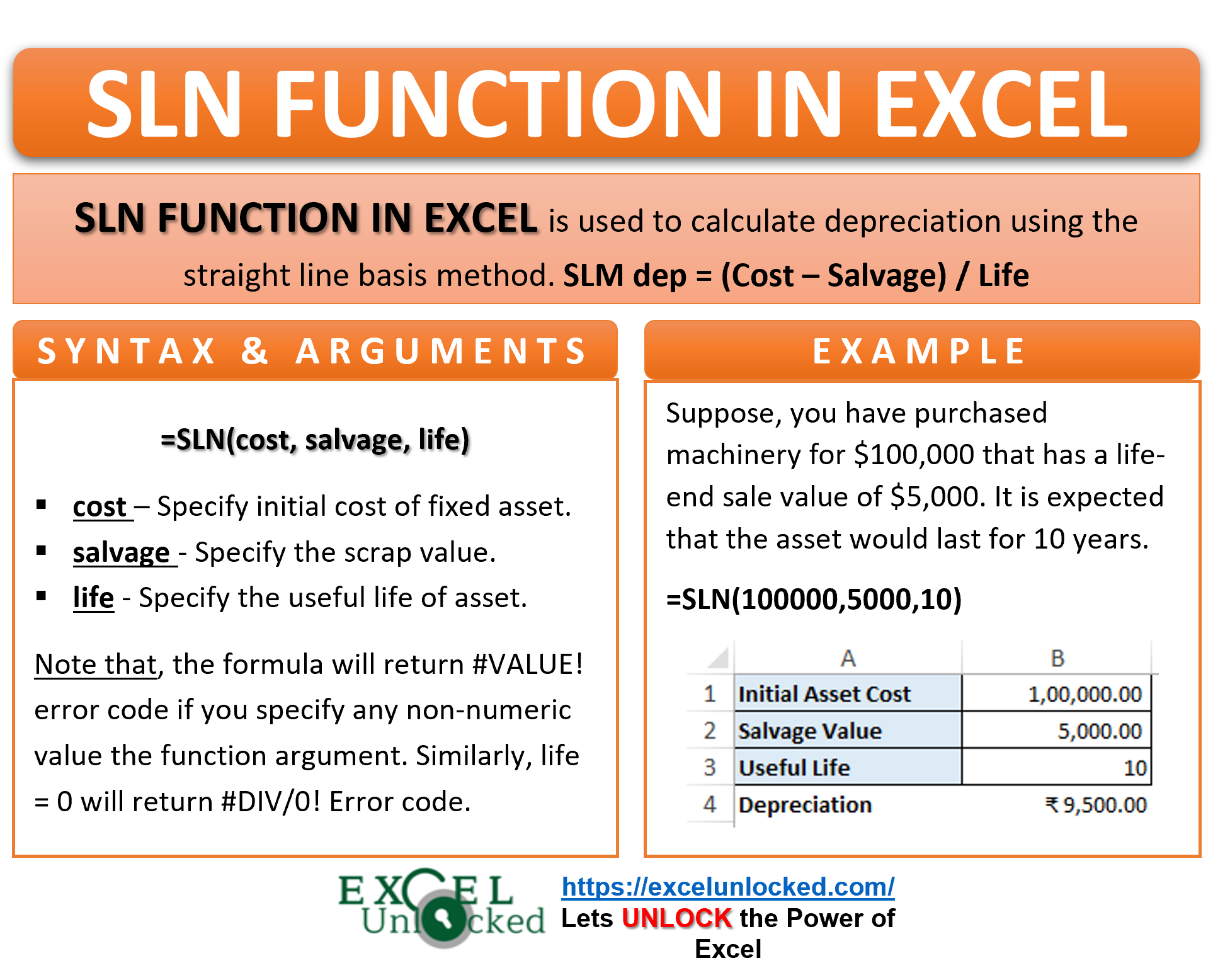

Eg car building etc. You can use the below Depreciation formula to calculate the depreciation rate. Excel 2016 lets you choose from four different depreciation functions each of which uses a slightly different method for depreciating an asset over time.

On this page you can calculate depreciation of assets over a given period of time. Written down value or the reducing balance method of depreciation is a method in which depreciation is calculated at a fixed percentage on the original cost in the first year. 5th Year - 19.

And based on those periods rates for WDV can be easily calculated. The use of book value the balance brought forward from the previous year and fixed rate of depreciation result in decreasing depreciation charges over the life span of the asset. 1st Year - 4507.

Depreciation rate Depreciation cost of asset 100 Browse more Topics under Depreciation Provision And Reserves Depreciation and Causes of Depreciation. However in the subsequent years depreciation is calculated at the same fixed percentage not on the original cost but on the written down values gradually reducing during the expected working life of the Asset due to charge of depreciation. It is a method of distributing the cost evenly across the useful life of the.

In this video on Written Down Value Method here we discuss how to calculate written down value WDV Depreciation along with practical examples and detail. Pro rata Depreciation New Asset acquired during the year In the 1st year. How to calculate depreciation as per Companies Act 2013 using WDV method.

4th Year - 747. 26 Wdv Method Of Depreciation Formula In Excel Background. The following formula determines the rate of depreciation under this method.

Lets understand the formula for calculating the rate of depreciation by the straight line method. Depreciation Schedule Template for. The formula used to calculate WDV rates is Rate of Depreciation R 1 sc 1n.

If WDV method is used need to find out rate of depreciation by using following formula and charge depreciation accordingly. An asset is considered to provide more value in the initial years than the later years. 1-sc1n100 where S Salvage Value C Carrying Amount as on 01-04-14 N Difference of useful life as per new and old schedule.

But it is more useful to use Written Down Method WDV as we have to use this method for Income-tax purposes.

Written Down Value Method Of Depreciation Meaning And Calculation

Sln Function In Excel Calculate Slm Depreciation Excel Unlocked

Depreciation Calculation Is Not Correct Manager Forum

Accounting Taxation Interest Rates Of Delay In I T Returns Submission I T Returns Non Submission Failure To Income Tax Return Interest Rates Pay Advance

Accounting Taxation Income Tax Deductions Lic Donation Mediclaim Pension Fund Home Loan Repayment Bank Fdr Etc Tax Deductions Income Tax Pension Fund

Depreciation Formula Calculate Depreciation Expense

Written Down Value Method Example How To Calculate Depreciation Under Wdv Method Youtube

Written Down Value Method Of Depreciation Calculation

Depreciation In Income Tax Accounting Taxation Income Tax Income Energy Saving Devices

Depreciation In Income Tax Accounting Taxation Income Tax Tax Refund Income

Gstr Due Dates In 2020 Due Date Dating Government

How To Adjust Depreciation With Accumulated Depreciation In A Work Sheet Quora

Written Down Value Method Of Depreciation Calculation

Written Down Value Method Of Depreciation Calculation

Written Down Value Method Of Depreciation Calculation

Application Of Time Value Of Money Concept To Wdv Depreciation Calculation

Income Tax Press Release Advance Pricing Agreements Apas Income Tax Income Tax

Straight Line Method Slm Reducing Balance Method Rbm Written Down Value Wdv Sum Of Year Digits And Annuity Design Course Method Digits

Posting Komentar untuk "Wdv Method Of Depreciation Formula"