Diminishing Balance Method Formula

First we will calculate the EMI. EMI calculation can be done using Excels PMT formula.

Declining Balance Depreciation Calculator

Cardholder has no beginning balance on his first statement and makes EasyPay Installment transaction of P50000 during the month Add-on rate will vary depending on the payment term selected.

Diminishing balance method formula. The depreciation rate is 60. Use the diminishing balance depreciation method to calculate depreciation expenses. Formulae are as follows.

Formula for Calculating Net Book. Thus the diminishing balance method formula is. Depreciation account of the balance sheet will look like below over the 8 years of the machines life.

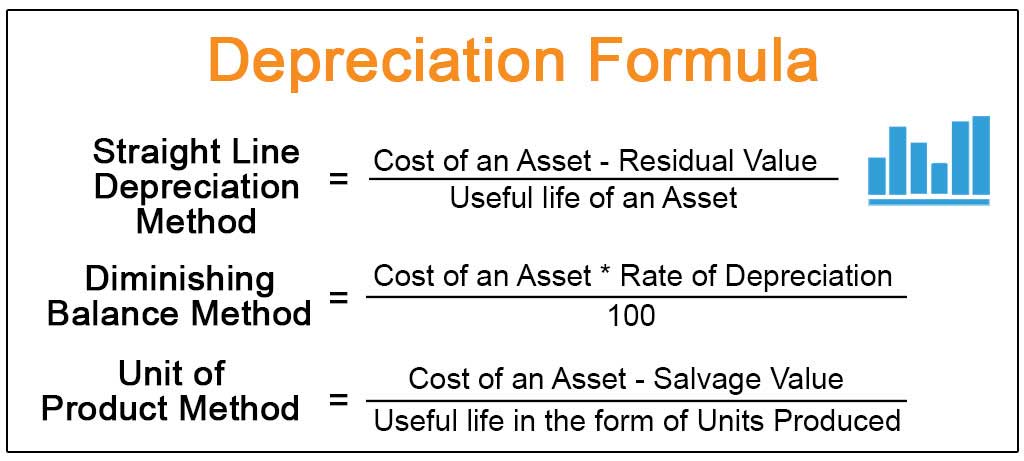

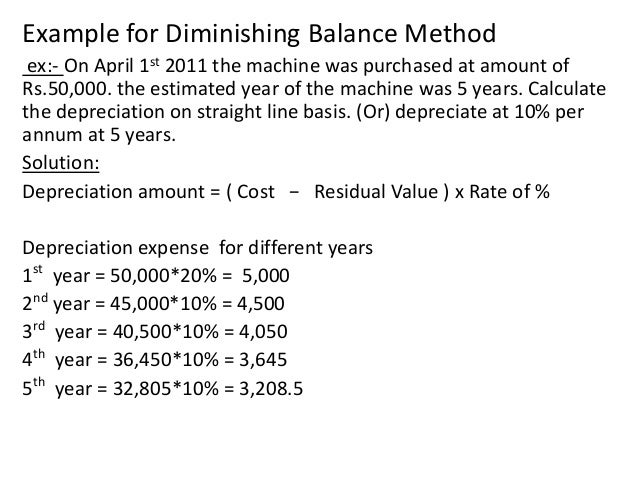

Show the Machinery Account for the three years from 2003 to 2005 December 31st. Under this method the asset is depreciated at fixed percentage calculated on the debit balance of the asset which is diminished year after year on account of depreciation. Depreciation expenses Net Book Value Residual Value Depreciation Rate Depreciation expenses are the charge of the fixed assets that are converted to the income statement of that specific period.

Under this method depreciation of one year is based on the previous years net book value ie what the asset is worth in the firmss account. Straight-Line Depreciation Percent 100 Useful Life. Well here the formula.

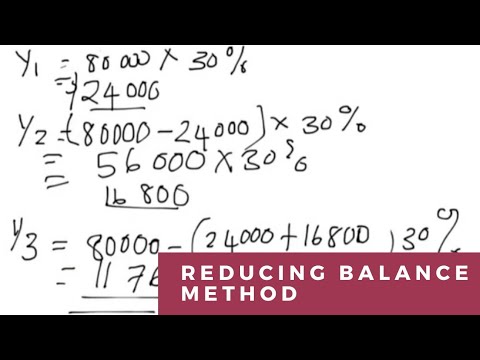

When declining balance method does not fully depreciate an asset by the end of its life variable declining balance method might be used instead. Year 2 Depreciation 75000 x 25 18750. Year 1 Depreciation 100000 X 25 25000.

Hence diminishing method refers to the reduction or declining method. Reducing balance method is also named as diminishing balance or written down value method. On every EMI payment outstanding loan amount reduces by the amount of principal repayment.

On 1st July 2003 it. The interest component of the EMI is larger in the initial repayments and gradually reduces over time when compared to the principal amount. EMI payment every month contains interest payable for the outstanding loan amount for the month plus principal repayment.

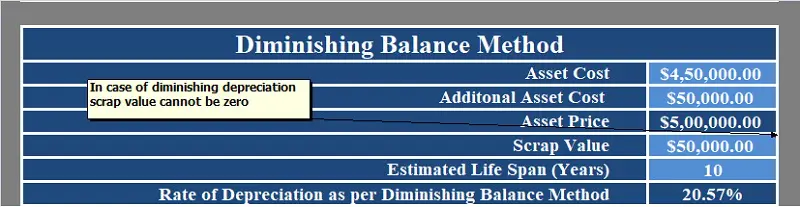

Diminishing Balance Depreciation is the method of depreciating a fixed percentage on the book value of the asset each accounting year until it reaches the scrap value. Read more about whether to invest money or use it to prepay loan. C B V current book value D R depreciation rate beginaligned textDeclining Balance Depreciation CBV times DR textbf.

On the Diminishing Balance Method. Depreciation Rate Depreciation Factor x Straight-Line Depreciation Percent. In every year depreciation is calculated on the written down value of the asset.

Because unlike fixed interest method here the interest. Diminishing Balance Sample Computation for EasyPay Installment Transactions Assumptions. In Diminishing Balance method we have calculated the depreciation on the closing value of an asset and charge until the book value of an asset will equal to its scrap value.

So whats the carrying amount. The amount of depreciation will be diminished or decreased as compared to last year because we charge the fixed rate of depreciation on the closing value of an asset. The declining balance method calculates interest at periodic intervals on the amount of the principal not yet repaid.

Declining Balance Depreciation C B V D R where. Reducing balance depreciation diminishing value This method of depreciation involves multiplying the asset carrying amount by the depreciation rate to calculate the depreciation that can be claimed that year. Diminishing balance method is also known as written down value method or reducing installment method.

In reducing balance method the EMI is lower than fixed interest method. Declining BalanceEqual installments. Formula for diminishing balance method The depreciation is charged at a given fixed percentage on the diminishing value of on assets every year.

The carrying amount is the value of the asset after any depreciation to date has been deducted from the original cost. Please note the difference in EMI between fixed Rs9042 and reducing balance method Rs8722. Here it will be 2 x 125 25.

Depreciation Expenses Net Book Value Residual value X Depreciation Rate. The exact percentage allocated towards payment of the. Depreciation was provided at 10 pa.

Double-declining balance formula 2 X Cost of the asset X Depreciation rate. As it uses the reducing book value it is also known as reducing balance method. Net Book Value USD 105000 first year equal to the cost of the car Residual value USD 5000.

As the written down value of the asset reduces the depreciation calculated on such value also reduces year after year although the rate of depreciation remains. Here is the value of each element. The net book value of a non-current asset is calculated as follows.

Income Tax Rules also allow depreciation charged on Diminishing Balance Method. Diminishing Balance Depreciation Definition. Diminishing Balance Method Formula Diminishing refers to reduction or decline.

In this method the depreciation amount decreases each year. Changes in Depreciation Method A company purchased a second-hand machine on 1st January 2002 for Rs 37000 and immediately spent Rs 2000 on its repairs and Rs 1000 on its erection. Repayment amounts EMI are equal.

Thus interest for next month is calculated. In Diminishing Balance Interest Rate method interest is calculated every month on the outstanding loan balance as reduced by the principal repayment every month. TextAmount of depreciation frac textBook Value.

O Level Accounting Methods Of Calculating Depreciation

Depreciation Methods Check Formula Factors Types Quickbooks

What Is Diminishing Balance Depreciation Definition Formula Accounting Entries Exceldatapro

Depreciation Diminishing Balance Method Youtube

Reducing Balance Depreciation Calculation Double Entry Bookkeeping

Reducing Balance Method Or Diminishing Balance Method Or Written Down Value Method Of Depreciation Formula Solved Example

How To Calculate Depreciation Using The Reducing Balance Method Diminishing Balance Method Youtube

Diminishing Balance Method Formula Journal Entries Solved Examples

Straight Line Vs Reducing Balance Depreciation Youtube

Declining Balance Depreciation Double Entry Bookkeeping

Straight Line Method Vs Diminishing Balance Method Depreciation Calculation Examples Youtube

Depreciation Formula Calculate Depreciation Expense

Human Resource Accounting October 2015

What Are The Different Ways To Calculate Depreciation

Reducing Balance Method For Calculating Depreciation Qs Study

Mc Grawhillirwin Copyright 2011 By The Mc Grawhill

What Is Diminishing Balance Depreciation Definition Formula Accounting Entries Exceldatapro

Posting Komentar untuk "Diminishing Balance Method Formula"