Wdv Depreciation Calculator

If you have already started using ABCAUS Excel Depreciation Calculator under the Cos Act 2013 in. At this stage this calculator might give you a quick help in ascertaining the WDV of the additions which comes to Rs.

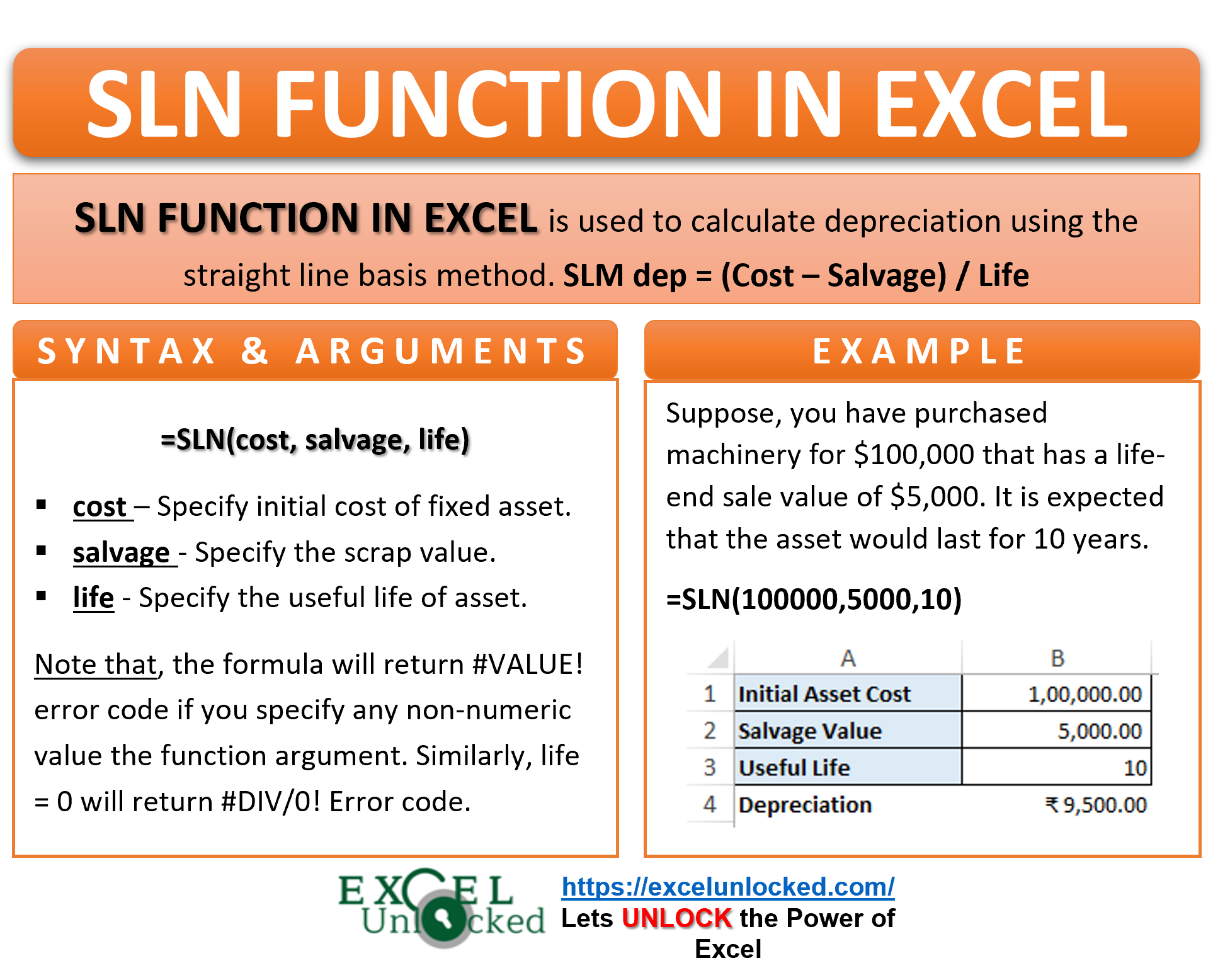

Sln Function In Excel Calculate Slm Depreciation Excel Unlocked

Date of Purchase of Asset.

Wdv depreciation calculator. For eg if an asset is of Rs. Upvote 1 Downvote 0 Reply 0 Answer added by Waleed Suliman financial and admin manager Almana International Group 2 years ago. For example for Year I Depreciation 1000000 x 1295 ie.

Residual Value Method of Calculation. Depreciation calculator tricksCA Calculator Hello everyone New batch available Online Live for class 11th and 12th so those who are interested contact. But for the next year your wdv will be considered as reduced by the percentage of depreciation prescribed.

Depreciation is calculated for a year and proportionately adjusted if used for less than a year. Thanks for your quick help. Straight Line Method The asset is depreciated equally every year over the useful life of the asset as a percentage of the Initial Cost.

Hey plz solve this problem. N useful life of the assets. 27 April 2012 Dear member how calculate wdv depreciation rate please give formulaif cost1000selvege0 time5 yearrate.

Depreciation Calculation - Written Down Value WDV Method For specific assets the newer they are the faster they depreciate in value. How to calculate Rate of Depreciation under WDV Method. 36887-94760-57873 represent the part which has to be written off.

It is also known as Reducing Balance or Reducing Installment Method or Diminishing Balance Method. How we can achieve the same. Vgood question- i am agree with mr.

For more about depreciation in accountancy and the formula used in reducing balance method refer to this wikipedia link. 57873- meaning thereby that remaining WDV of Rs. In the WDV method depreciation is charged on the book value of such an asset and every year the book value decreases.

WDV depreciation calculation Depreciation rates and rules may vary for different countries and the information on those may be obtained from the concerned department. The ABCAUS Depreciation calculator for FY 2020-21 has also been formulated and styled the same way as its predecessor so that users find themselves familiar with it. 30000 as depreciation in this case next year wdv will be considered as rs.

The maiden ABCAUS Excel Companies Act 2013 Depreciation Calculator was first launched in March 2015. Depreciation for the year is the rate in percentage multiplied by the WDV at the beginning of the year. Dharmender Article 04 February 2015.

Depreciation can be claimed at lower rate as per income tax act. Cost of Acquisition No. In these situations the declining balance method tends to be more accurate than the straight-line method at reflecting book value each year.

R 1 - sc 1nx 100 Where R Rate of Depreciation in n Useful life of the asset in years s Scrap value at the end of useful life of the asset c Cost of the asset. Depreciation for the first year 10. Depreciation Calculator - Calculate online Straight Line Method SLM Written Down Value WDV.

Please let me know how we can calculate the depreciation in SAP with fixed percentage rate with WDV method for current year. Also they want to change the method of calculating the depreciation from WDV to SLM from the next year. You can use either Straight Line Method SLM or Written Down Method WDV.

Depreciation Calculator as per Companies Act 2013. This calculator is meant for companies following April to March Financial year. Concept of Written Down Value Method of Depreciation.

The formula used to calculate WDV rates is Rate of Depreciation R 1 sc 1n. 20000 only not rs. Online Depreciation Calculator SLM WDV Method SLM Depreciation Rate is 950 per annum and Annual depreciation is 950000 You can use this Calculator to Calculate Depreciation Online for Free.

Where s scrap value at the end of period n. As these assets age their depreciation rates slow over time. Let us see this through an example.

Of years to write off. Written Down Value Method The method distributes the asset depreciation unevenly throughout its life. Under this method the depreciation is calculated at a certain fixed percentage each year on the decreasing book value commonly known as WDV of the asset book value less depreciation.

1 lakh and 80 depreciation is prescribed for the asset and you charge only rs. Please login to bookmark. Suppose the cost of the asset is Rs 100000.

C Written down value at present. 1 025 01 1295 approx Now you can use this WDV rate to calculate depreciation.

Depreciation Formula Calculate Depreciation Expense

What Is Depreciation And How It Is Calculated Problem B Youtube

Depreciation Calculator Tricks Wdv Method Youtube

How To Calculate Depreciation On Fixed Assets Fixed Asset Economics Lessons Small Business Bookkeeping

Calculate Depreciation In 10 Seconds By Written Down Value Wdv Method Jaiib Accounts Youtube

Depreciation Rates And Provisions As Per Companies Act 2013 Taxadda

Declining Balance Depreciation Method Anaplan Community

How To Adjust Depreciation With Accumulated Depreciation In A Work Sheet Quora

Written Down Value Method Of Depreciation Calculation

Depreciation Calculation Is Not Correct Manager Forum

Straight Line Method Slm Reducing Balance Method Rbm Written Down Value Wdv Sum Of Year Digits And Annuity Design Course Method Digits

Written Down Value Method Of Depreciation Calculation

How To Calculate Wdv Student Jobs Job Things To Sell

Abcaus Excel Depreciation Calculator Fy 2020 21 Companies Act 2013

Taxadda Depreciation Calculator As Per Companies Act 2013

Accounting Taxation Income Tax Deductions Lic Donation Mediclaim Pension Fund Home Loan Repayment Bank Fdr Etc Tax Deductions Income Tax Pension Fund

Accounting Taxation Interest Rates Of Delay In I T Returns Submission I T Returns Non Submission Failure To Income Tax Return Interest Rates Pay Advance

Application Of Time Value Of Money Concept To Wdv Depreciation Calculation

Posting Komentar untuk "Wdv Depreciation Calculator"