Diminishing Balance Formula Excel

Formula to Calculate Depreciation Rate To calculate the depreciation rate divide the 1 by the useful life of the asset. The balance formula in row 3 now contains a ref.

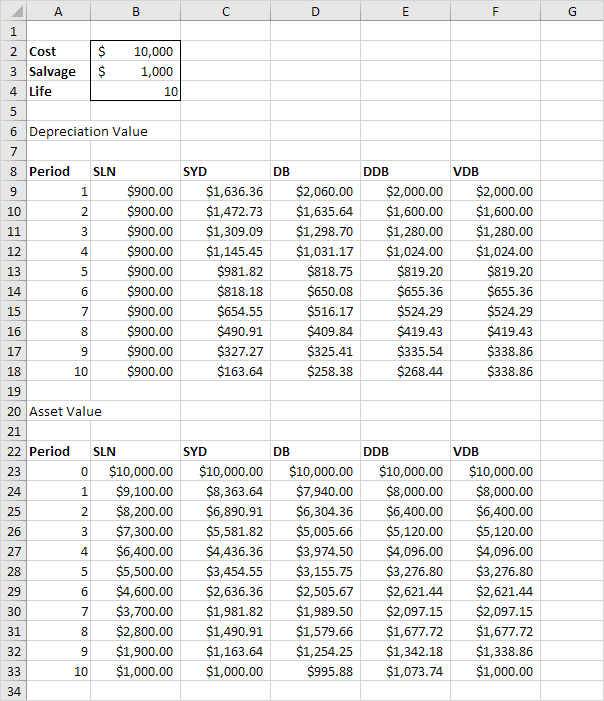

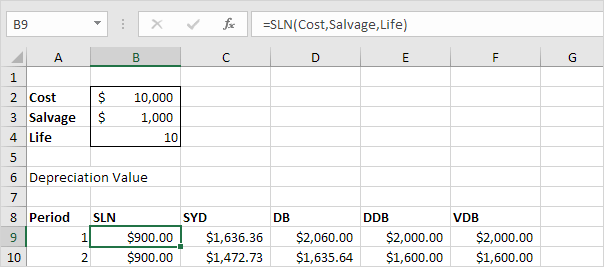

Depreciation In Excel Easy Excel Tutorial

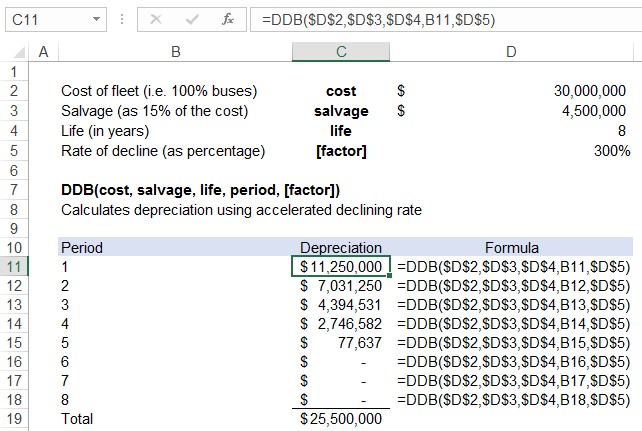

Initial Cost Total depreciation from prior periods Rate.

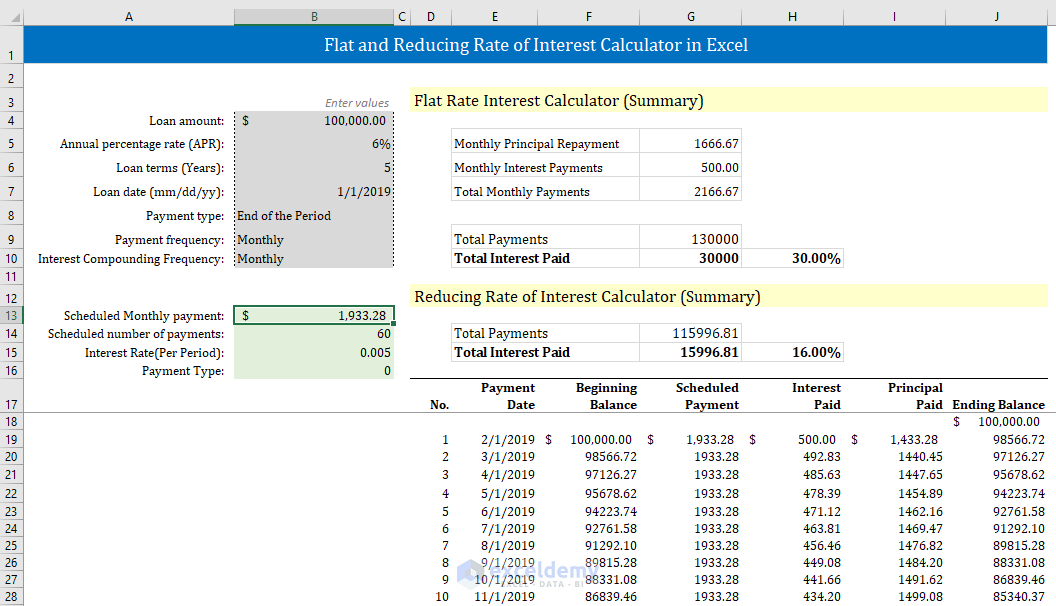

Diminishing balance formula excel. 25000 7500 17500. Please note the difference in EMI between fixed Rs9042 and reducing balance. Hence we are using Excel to do the computation.

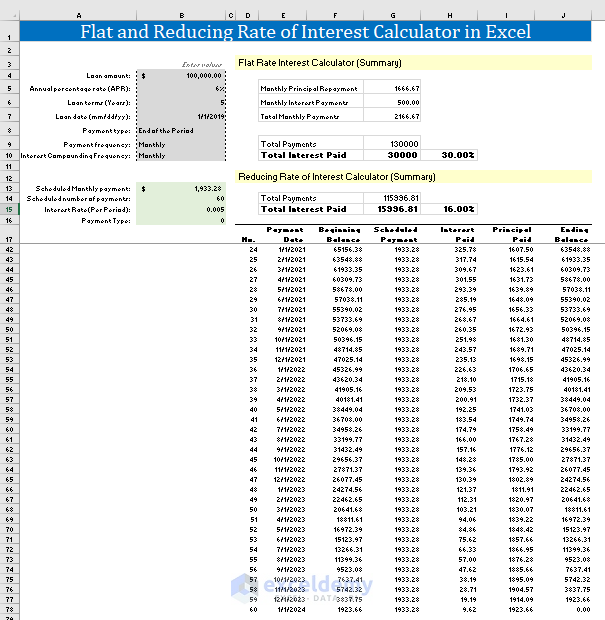

On every EMI payment outstanding loan amount reduces by the amount of principal repayment. Diminishing balance method in accounting is the method by which the total amount of the depreciation can be calculated like some fixed percentage of the diminishing and reducing value of any asset that can stand in books during the beginning of an annual year so that it can bring the book value down to its initial residual value. To calculate the depreciation for a partial year multiply the depreciation of full-year with the number of months and then divide it by 12.

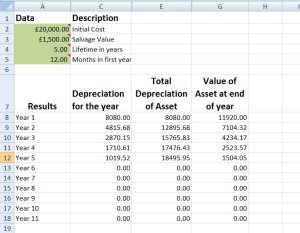

Deprecation value period 2 10000 -. Finance in Excel 5 - Calculate Declining Balance Method of Depreciation in Excel - YouTube. Formulas to Calculate Diminishing Balance Depreciation Formula To Calculate Partial Depreciation Companies dont purchase the asset at the beginning of the accounting year.

In reducing balance method interest calculation is complicated. Hence they need to depreciate the asset partially for that year for accounting purposes. Know at a glance your balance and interest payments on any loan with this loan calculator in excel.

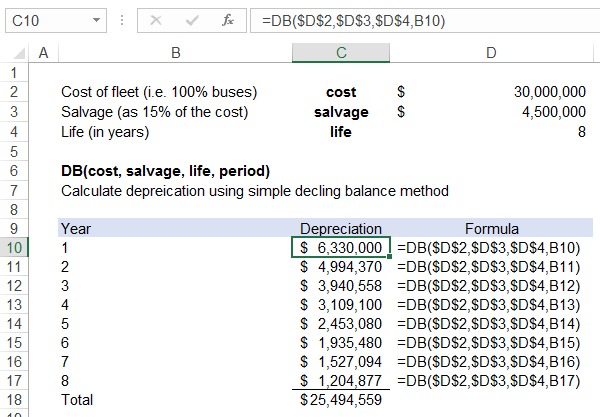

The DB function performs the following calculations. In Diminishing Balance Interest Rate method interest is calculated every month on the outstanding loan balance as reduced by the principal repayment every month. Hence they need to depreciate the asset partially for that year for.

Multiply the book value by the depreciation rate. This formula is applicable to calculate the partial depreciation in any method. Declining BalanceEqual installments.

The exact percentage allocated towards payment of the. Diminishing balance depreciation is the method of depreciating a fixed percentage on the book formula. These excel template loan repayment reducing balance work on all being the preferred option compared to the fixed interest rate reducing balance rate or the diminishing rate is used to calculate the interest.

Use the diminishing balance depreciation method to calculate depreciation expenses. Depreciation Expenses Net Book Value Residual value X Depreciation Rate. Here is the value of each element.

Net Book Value USD 105000 first year equal to the cost of the car Residual value USD 5000. The declining balance method calculates interest at periodic intervals on the amount of the principal not yet repaid. Depreciation value period 1 10000 0206 206000.

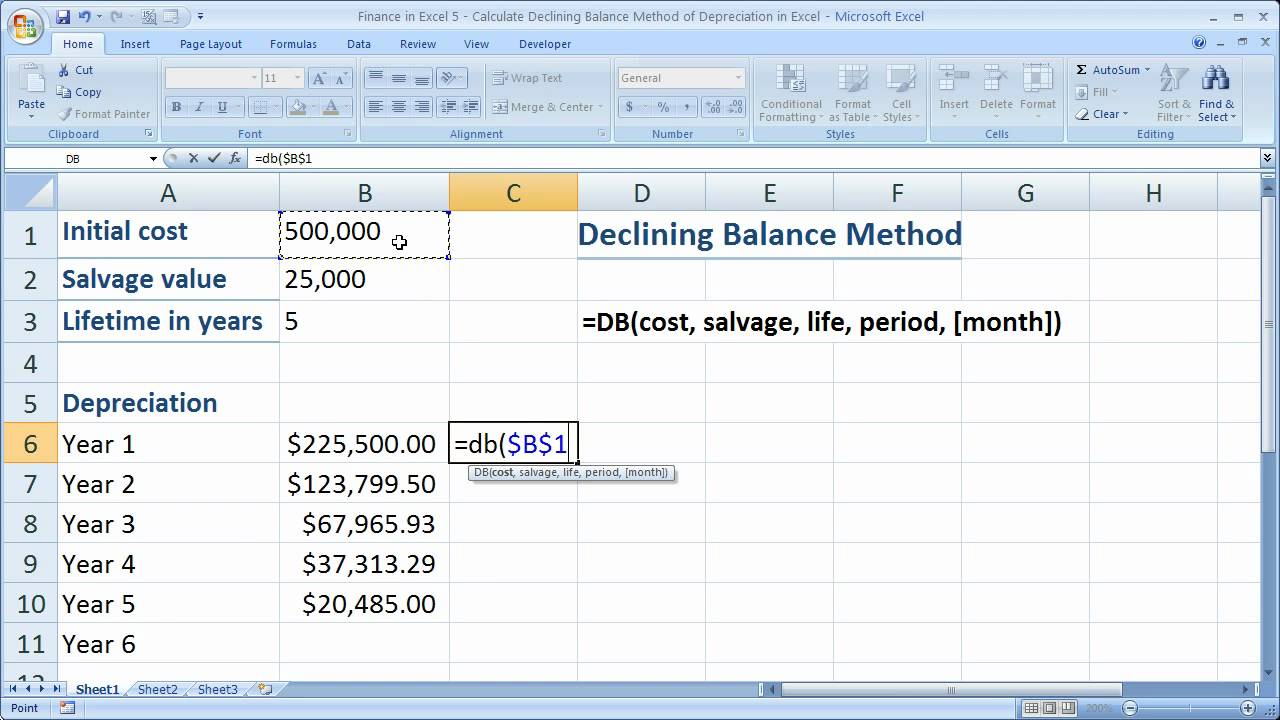

DB is an Excel function that calculate the depreciation charge in any period directly using the variable declining balance method. EMI payment every month contains interest payable for the outstanding loan amount for the month plus principal repayment. Finance in Excel 5 - Calculate Declining Balance Method of Depreciation in Excel.

Carrying amount x depreciation rate depreciation expense. The interest component of the EMI is larger in the initial repayments and gradually reduces over time when compared to the principal amount. Fixed rate 1 - salvage cost 1 life 1 - 100010000110 1 - 07943282347 0206 rounded to 3 decimal places.

First we will calculate the EMI. The DB Declining Balance function is a bit more complicated. Well here the formula.

Diminishing Balance Depreciation Calculation Similar to the above section enter Asset Cost and Additional Asset Cost to obtain total Asset Price. The process of creating a running total in excel involves three fairly simple steps. DBcost salvage life period month.

Diminishing balance depreciation is the method of depreciating a fixed percentage on the book formula to calculate partial depreciation. EMI calculation can be done using Excels PMT formula. Because we are using the reducing balance method depreciation for the year ended 30th June 2010 is calculated as follows.

Enter the Scrap Value and Life Span of the asset. Original cost depreciation to date carrying amount. It uses a fixed rate to calculate the depreciation values.

The DB function in excel uses the following mathematical expression to calculate depreciation using the fixed-declining balance method for a particular period except first and last period. Calculating Diminishing Marginal Returns in Excel To calculate the diminishing marginal return of product production obtain values for the production cost per unit of production. Diminishing balance formula excel.

The depreciation rate is 60. Thus interest for next month is calculated. 17500 x 40 7000.

Repayment amounts EMI are equal. OFFSET reference rows columns height width To refer to the previous balance we can use the current balance F15 as the reference and use -1 for the offset rows and 0 for the offset columns like this.

Reducing Balance Method Of Loan Calculation Online Calculator Excel Working Getmoneyrich

How To Use The Excel Db Function Exceljet

Depreciation Formula Examples With Excel Template

Declining Balance Depreciation In Excel Example

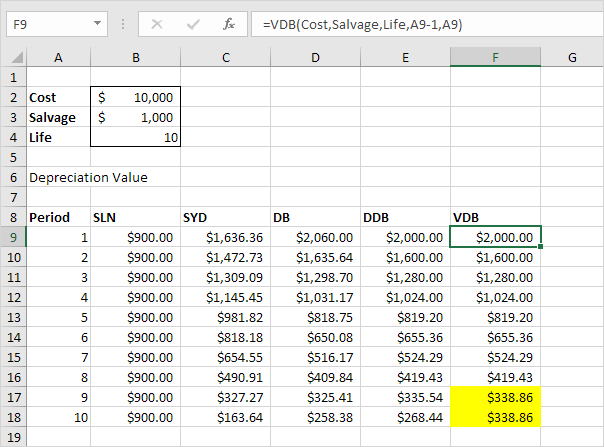

How To Use The Excel Ddb Function Exceljet

Depreciation In Excel Easy Excel Tutorial

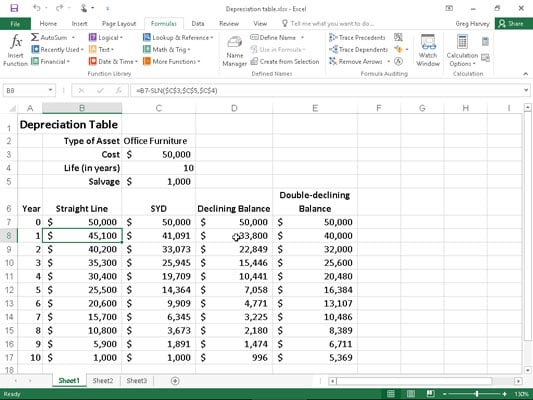

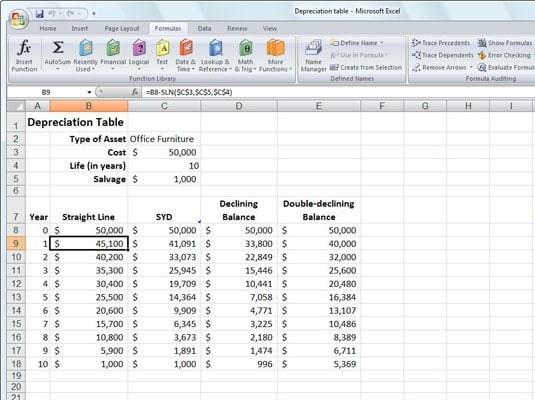

How To Use Depreciation Functions In Excel 2016 Dummies

How To Calculate Depreciation In Excel Excel Examples

Finance In Excel 5 Calculate Declining Balance Method Of Depreciation In Excel Youtube

Flat And Reducing Rate Of Interest Calculator In Excel Free Download

Declining Balance Depreciation Double Entry Bookkeeping

Reducing Balance Depreciation Calculator Double Entry Bookkeeping

Depreciation In Excel Easy Excel Tutorial

Depreciating Assets With Excel 2007 S Sln Syd Db And Ddb Functions Dummies

Microsoft Excel Tutorial Lesson 15 Business And Financial Functions

Flat And Reducing Rate Of Interest Calculator In Excel Free Download

Double Declining Balance Depreciation In Excel Example

Depreciation Reducing Balance Method Free Calculator

Posting Komentar untuk "Diminishing Balance Formula Excel"