Wdv Depreciation Formula

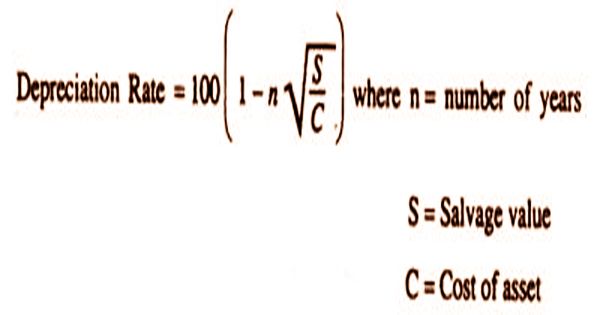

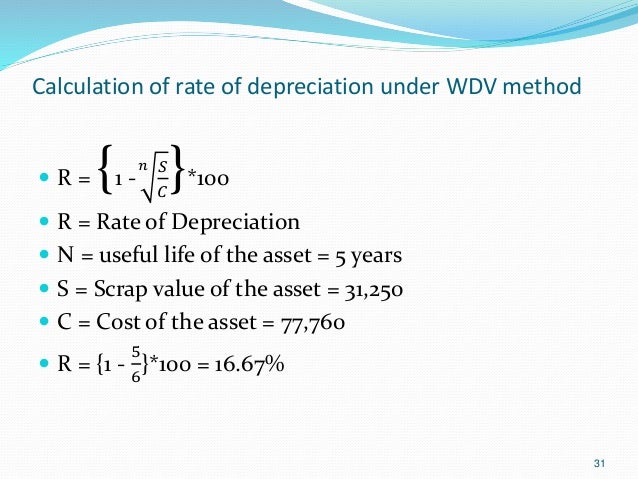

In straight-line method depreciation is calculated on the original cost. WDV is a method of depreciation in which a fixed rate of depreciation is charged on the book value of the asset over its useful life.

Straight Line Method Slm Reducing Balance Method Rbm Written Down Value Wdv Sum Of Year Digits And Annuity Design Course Method Digits

On the other hand in the written down value method the calculation of depreciation is on the basis of written down value of the asset.

Application Of Time Value Of Money Concept To Wdv Depreciation Calculation

Written Down Value Method Of Depreciation Calculation

Sln Function In Excel Calculate Slm Depreciation Excel Unlocked

Definitions Depreciation In Fixed Assets The Monetary Value Starts To Decreases Over Time Due To Use Wear And T Fixed Asset Explained Marketing Trends

Depreciation In Income Tax Accounting Taxation Income Tax Income Energy Saving Devices

How To Calculate Wdv Student Jobs Job Things To Sell

Depreciation Formula Calculate Depreciation Expense

Depreciation Written Down Value Method Part 2 In English Accountancy Video Lectures

Written Down Value Method Of Depreciation Calculation

Accounting Taxation Interest Rates Of Delay In I T Returns Submission I T Returns Non Submission Failure To Income Tax Return Interest Rates Pay Advance

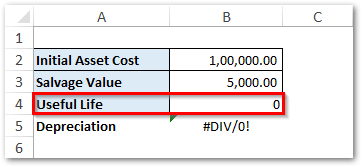

Depreciation Calculation Is Not Correct Manager Forum

Written Down Value Wdv Assignment Point

How To Calculate Depreciation On Fixed Assets Fixed Asset Economics Lessons Small Business Bookkeeping

Depreciation In Income Tax Accounting Taxation Income Tax Tax Refund Income

4 Ways To Calculate Depreciation On Fixed Assets Wikihow

Unit Of Production Depreciation Method Formula Examples

Depreciation Calculator Tricks Wdv Method Youtube

Posting Komentar untuk "Wdv Depreciation Formula"